Busting a Big Real Estate Myth with Data

Why Your Home Isn’t a Magic Money Machine

*An article by GharInsight.com*

As a real estate expert, I’ve heard my share of misconceptions, but one stands above all others: the idea that property prices always go up. This belief, while comforting, can lead to poor financial decisions. At GharInsight.com, we believe in arming our readers with data-driven insights to navigate the market wisely.

Let’s use hard numbers and recent news to debunk this myth and uncover the cyclical nature of real estate, with a special focus on the dynamic markets of Mumbai and Pune.

The Illusion vs. The Reality: A Data-Driven Perspective

The narrative of “always-up” real estate is powerful, often fueled by anecdotes and short-term market peaks. But historical analysis tells a different story. The infamous U.S. housing bubble of 2008 is a stark reminder of what happens when markets overheat. More locally, while Indian metros have seen strong growth, they are not immune to market corrections and cycles. The real estate cycle, as identified by research from sources like Investopedia, consists of four phases: Recovery, Expansion, Hyper Supply, and Recession. Understanding which phase your market is in is crucial.

Mumbai & Pune: A Tale of Two Markets

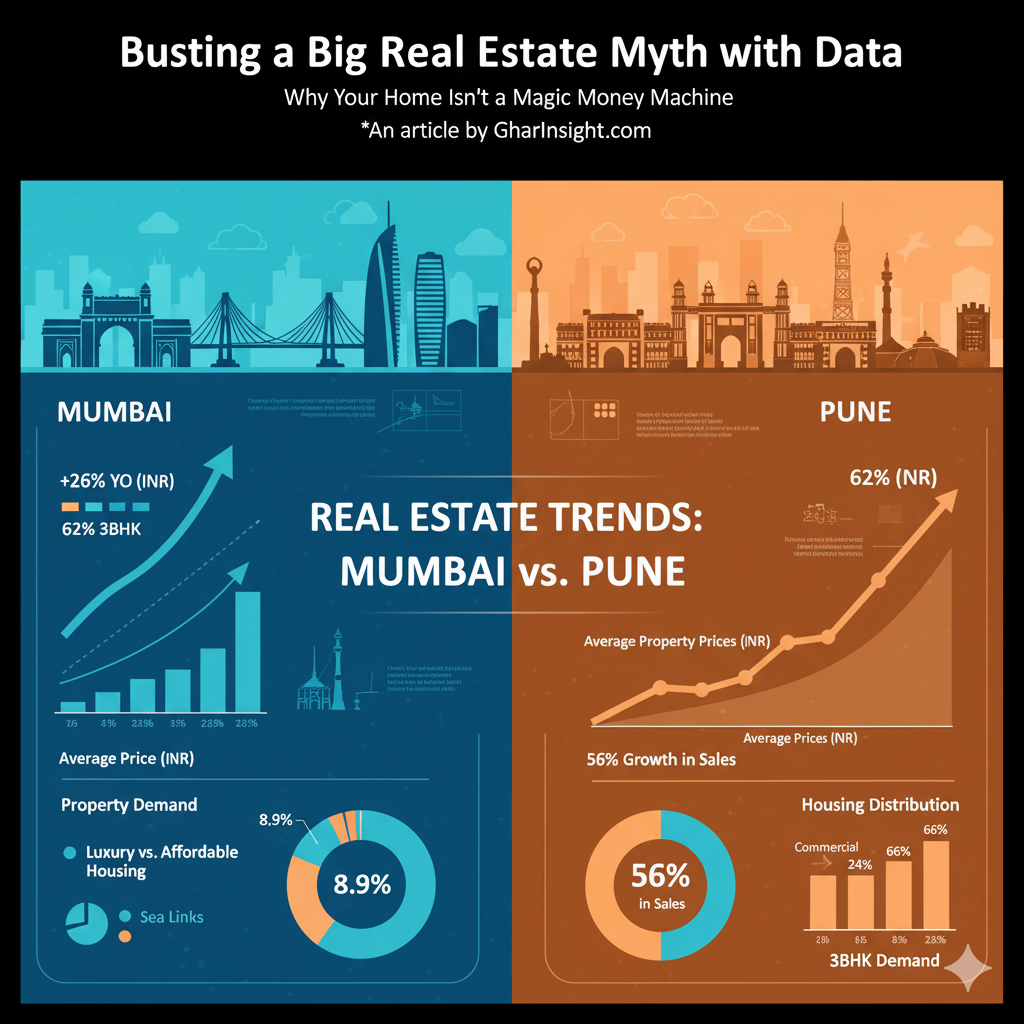

Let’s look at the data from two of India’s most talked-about markets. The chart below visualizes the average price per square foot over time for both cities, illustrating their distinct trends.

Market Trends: Mumbai vs. Pune (₹/sq. ft.)

The Mumbai Market: Infrastructure and Luxury Drives Prices

Mumbai’s real estate market is often seen as an unstoppable force. Recent data from the Maharashtra Department of Registrations and Stamps (IGR) confirms this, with a surge in property registrations in H1 2025. This growth, however, isn’t across the board; it’s heavily skewed.

- The Luxury Segment is King: A joint report by CREDAI-MCHI found the weighted average price in the Mumbai Metropolitan Region (MMR) rose to **₹21,318 per sq. ft** in Q2 2025. This is largely driven by premium and luxury homes.

- Infrastructure as a Growth Engine: Projects like the **Mumbai Trans Harbour Sea Link (MTHL)** and the **Navi Mumbai International Airport** are directly influencing property values. Reports from Savills highlight how these infrastructure projects are attracting both domestic and NRI buyers.

A Word of Caution: While these numbers are impressive, a recent report from PropEquity, highlighted by Hindustan Times, shows a significant decline in sales and new launches in Mumbai, Thane, and Navi Mumbai in Q2 2025. This suggests that the market may be entering a consolidation phase after a period of high growth.

The Pune Market: Affordability and Stable Growth

Pune presents a different, and perhaps more sustainable, growth model. It has consistently ranked as India’s top-performing real estate market, thanks to a balanced ecosystem of affordability, robust job opportunities, and strategic development.

- Affordability is Key: According to a CREDAI Pune Metro and CRE Matrix report, Pune’s average home price of **₹75 lakh** makes it significantly more affordable than Mumbai (₹2.26 crore).

- Job Market Fuels Demand: Pune’s status as a hub for both the IT and manufacturing sectors ensures a constant inflow of professionals. This has led to an impressive **56% growth in sales volume** over the last five years.

The Takeaway for Smart Investors

The data is clear: real estate is not a linear investment. By looking beyond the myth and embracing a data-driven approach, you can make smarter, more resilient real estate decisions.

- Do Your Due Diligence: Don’t just rely on a property’s recent appreciation. Use data from reputable sources to understand the long-term trends of your chosen locality.

- Focus on Fundamentals: A property’s value is tied to its location. Is it close to a new metro line, a corporate park, or a school? These factors offer resilience during a downturn.

- Think Long-Term: Real estate is a long-term investment. The current data shows a period of consolidation in some markets, which might be the perfect time to buy for a long-term horizon.

Want to learn more? Explore our comprehensive Mumbai Property Guides and Pune Market Reports for deeper, hyper-local insights.

Sources:

- Investopedia – Has Real Estate or the Stock Market Performed Better Historically?

- FortuneBuilders – Understanding the Four Phases of the Real Estate Cycle

- CREDAI-MCHI – Mumbai Residential Real Estate Market Q2 2025

- CREDAI Pune Metro – CRE Matrix – Pune Housing Report – Feb’25

- Hindustan Times – Mumbai, Thane, Navi Mumbai, and Pune see a decline in housing sales and supply in Q2 2025

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Readers should conduct their own research and consult with a qualified real estate or financial professional before making any investment decisions.